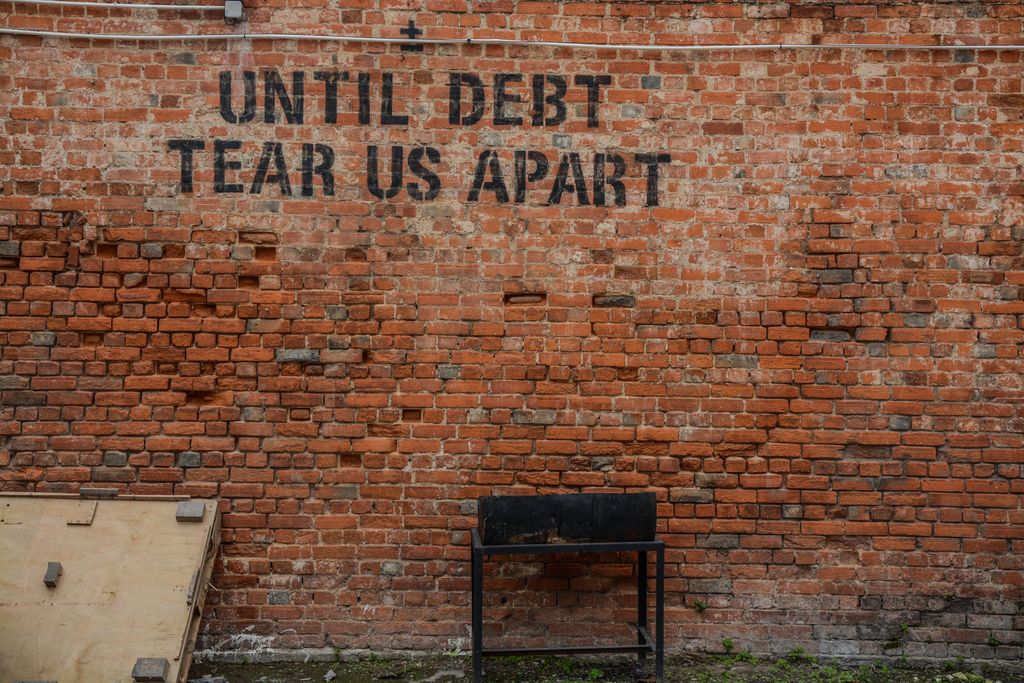

Small service providers often face challenges when it comes to clients settling their debt. This article explores the impact of unsettled debt on small service providers, common reasons for clients not settling their debt, the financial strain it puts on small service providers, and legal options available for them to recover the debt.

Key Takeaways

- Unsettled debt can have a significant impact on the cash flow and sustainability of small service providers.

- Common reasons for clients not settling their debt include financial difficulties, disputes over services rendered, and lack of communication.

- The financial strain caused by unsettled debt can lead to difficulties in paying bills, meeting payroll, and investing in business growth.

- Small service providers have legal options available to them to recover debt, such as sending demand letters, filing a lawsuit, or hiring a debt collection agency.

- It is important for small service providers to have clear payment terms, effective invoicing systems, and proactive communication with clients to minimize the risk of unsettled debt.

Understanding the Challenges Faced by Small Service Providers

The Impact of Unsettled Debt on Small Service Providers

Unsettled debt can have significant consequences for small service providers. It creates financial strain and can hinder our ability to meet our own financial obligations. Without prompt payment, we may struggle to cover operating costs, pay our employees, and invest in our business’s growth. This can lead to a cycle of financial instability and limited resources.

Common Reasons for Clients Not Settling Their Debt

When clients fail to settle their debt, small service providers like us face numerous challenges. Collecting unpaid fees becomes a major concern, impacting our cash flow and overall financial stability. It’s frustrating when clients don’t fulfill their payment obligations, leaving us in a difficult position.

The Financial Strain on Small Service Providers

As small service providers, we face numerous challenges in our day-to-day operations. One of the most significant challenges is the financial strain caused by unsettled debt. When clients fail to settle their debt, it puts a tremendous burden on our cash flow and overall financial stability. We rely on timely payments to cover our expenses and invest in the growth of our business. However, when clients delay or refuse to pay, it creates a domino effect that affects every aspect of our operations.

Legal Options for Small Service Providers to Recover Debt

When it comes to recovering debt, small service providers like us face various challenges. Disputes with clients can often hinder the process and prolong the resolution. It is important for us to navigate these disputes carefully and find the most effective solutions.

Small service providers face numerous challenges in today’s competitive business landscape. From limited resources and funding to difficulties in attracting and retaining customers, these obstacles can hinder their growth and success. However, with the right strategies and support, small service providers can overcome these challenges and thrive in their respective industries. At Debt Collectors International, we understand the unique challenges faced by small service providers, and we offer tailored debt collection solutions to help them recover outstanding payments and improve their cash flow. Our team of experienced professionals is dedicated to providing simple and effective debt collection services, ensuring that small service providers can focus on what they do best – delivering exceptional services to their clients. Visit our website today to learn more about how Debt Collectors International can help your business succeed.

Frequently Asked Questions

1. Why do clients not settle their debt with small service providers?

There can be various reasons why clients do not settle their debt with small service providers. It could be due to financial difficulties, disputes over the quality of services provided, lack of communication, or simply negligence.

2. How can small service providers deal with clients who refuse to settle their debt?

Small service providers can take several steps to deal with clients who refuse to settle their debt. This may include sending reminders, offering flexible payment options, seeking legal assistance, or even taking the matter to small claims court.

3. What are the potential impacts of unsettled debt on small service providers?

Unsettled debt can have significant impacts on small service providers. It can lead to cash flow problems, hinder business growth, strain relationships with suppliers, and even threaten the survival of the business.

4. Are there any legal options for small service providers to recover debt from clients?

Yes, small service providers have legal options to recover debt from clients. They can send demand letters, hire collection agencies, file lawsuits, or seek arbitration or mediation services to resolve the dispute.

5. How can small service providers prevent clients from not settling their debt?

Small service providers can take proactive measures to prevent clients from not settling their debt. This includes having clear payment terms and policies, conducting thorough credit checks on clients, establishing strong communication channels, and maintaining good customer relationships.

6. What should small service providers do if a client consistently refuses to settle their debt?

If a client consistently refuses to settle their debt, small service providers should consider taking stronger actions. This may involve seeking legal recourse, engaging debt collection agencies, or even terminating the business relationship to protect their own financial stability.

Comments are closed